Ex-ante Cost/Benefit Analysis of Business Cases for Energy-Efficient Navigation

- Analysis, Benefit, Cost, Energy Efficient

This PROMINENT report, Deliverable 2.4, presents the ex-ante cost/benefit analyses for energy efficient navigation. The major goal of energy-efficient navigation is to reduce the fuel consumption of a vessel while preserving or even improving the service quality of transportation. This shall result in cost savings for the ship owner/operator, as well as a reduction of climate emissions (CO2) and air-pollutant emissions such as NOx and PM. Fuel savings are expected to result from sailing at the optimal location in the fairway (causing the least resistance), as well as by means of optimising the sailing speed based on the actual conditions of the waterway.

This report presents the costs and benefits from the viewpoint of the shipowner/operator. The economic advantage for the ship owner/operator is a decisive element for the roll-out potential of energy-efficient navigation.

The work started with desk research on various costs estimations and impacts of energy-efficient navigation (notably fuel savings), based on a great number of programmes and research projects. The main sources consulted were COVADEM, MoVe IT!, IRIS EUROPE 3, NEWADA Duo, Voortvarend besparen, Econaut, Topofahrt, CREATING and The Cleanest Ship, describing different systems and tools, as well as test results derived with relevance to energy-efficient navigation.

This desk research provided however an unclear and scattered view on the costs and the estimated fuel savings. There is a large bandwidth in the cost, as well as the fuel-saving estimations. This wide uncertainty shows the need for the pilot activity to be carried out in PROMINENT, as a clear view is needed on the economic value of energy efficient navigation, taking into account differentiated costs and benefits for different types of waterways and vessels. In order to be able to calculate the costs and benefits, a scenario approach was used. The following tables present the bandwidth of values for the costs of the on-board unit and equipment, as well as the fuel consumption assumed. It is noted that the results presented are supposed to be of the correct order of magnitude. Deviations are expected, becoming clearer once the results of the pilots are known.

| Costs of on-board unit and equipment | Low | Medium | High |

| Ordinary echo-sounder: 10,000 EUR (COVADEM approach) | Advanced echo-sounder: 40,000 EUR (NAVROM pilot) | Sophisticated ADCP (or GNSS GPS) and advanced echo-sounder: 80,000 EURO (BAW – NEWADA DUO) |

Table 30: Bandwidth in costs relating to the on-board unit and equipment.

| Fuel consumption savings | Low | Medium | High |

| 3% | 14% | 25% |

Table 31: Bandwidth in fuel-consumption savings.

Three scenarios have been defined:

| Pessimistic scenario | Base-case scenario | Optimistic | |

| Investment in on-board unit and equipment | 80,000 EUR | 40,000 EUR | 10,000 EUR |

| Fuel saving | 3% | 14% | 25% |

Table 32: Scenario characteristics.

Moreover, the time for installation of the hardware and equipment was assumed at 1 day with an average value of 2000 Euro. In addition, an annual cost of 3000 EUR was taken into account to cover variable costs for communication, maintenance, training etc.

Since the effect to be expected is a reduction of fuel consumption, the economic saving is very much dependent on the fuel price. Since the fuel price is volatile, a sensitivity analyses was carried out also for the fuel price with the following values:

| Fuel price per 100 litre | Low | Medium | High |

| 23.65 EUR (February 2004) | 49.25 EUR per 100 litre (monthly average in period January 2004 – September 2015) | 67.81 EUR (July 2008) |

Table 33: Fuel price settings for sensitivity analyses.

The results of the calculations of the costs and benefits show that the business case is very much depending on the total fuel consumption of the vessel. The costs and benefits were calculated for the fleet families and for the representative journeys (defined in PROMINENT WP1.1), taking into account the estimations on their annual fuel consumptions.

Results base case

For the base case, the business case is positive from a fuel consumption of around 70 m3 per year in case of high fuel prices, around 100 m3 per year for average fuel prices and 250 m3 per year for low fuel prices. In case of very high fuel-consumption figures such as 1000 m3 per year, the total sum of the discounted saving (NPV) over a 15 year period can be 250,000 EUR at low fuel prices and up to 850,000 EUR at high fuel prices. Compared to an investment of 40,000 EUR, these benefits are quite remarkable. This means that each euro initial investment (40,000 EUR) will yield 21 times more money (850,000 EUR / 40,000 EUR) in case of high fuel prices over a 15 year time period and about 6 times more in case of low fuel prices (250,000 / 40,000 EUR).

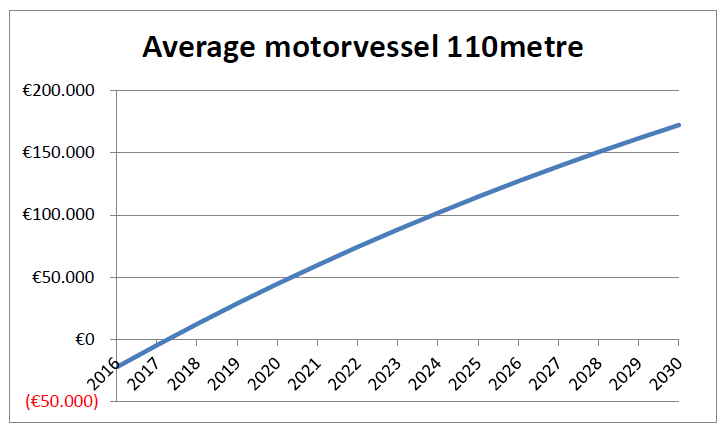

Since the 110 meter dry-cargo motor vessel is considered as the “working horse” for European inland waterway transport, the following graph shows the development of the cash flow after the 40,000 EUR investment at the average fuel price of 49.25 EUR per 100 litre. The result presented is based on an estimated annual fuel consumption of 311 m3 per year.

Figure 20: Development of Net Present Value (NPV) over time presented for the base-case scenario and the average fuel price considered for a 110 metre vessel. Note: e.g. 2016 means end of the year 2016.

It can be seen that after an initial investment taken in the first year (end of 2015), the benefits are providing a break-even situation already after 2.5 years. The Net Present Value for this time span is 172,000 EUR and the Internal Rate of Return is 41 %. This is quite significant and positive.

Results pessimistic scenario

The CBA calculations for the pessimistic scenario illustrate that only really large vessels such as 6-barge pushed convoys have some benefit in case of average or high fuel prices due to their high fuel consumption values. Assuming the average fuel price, a break-even situation is given for vessels with a yearly fuel consumption of 800 m3. However, it shall be reminded that the calculation takes into account the savings over a period of 15 years while the fuel price development is quite uncertain. Therefore, the risk to be taken as regards the fuel price development shall be incorporated in these investment decisions. The ship owner/operator will expect a higher Return on Investment (ROI). In general, the Internal Rate of Return shall be at least 4 %. For the pessimistic scenario, at the average fuel price a 4 % return rate is reached in case of 1000 m3 fuel consumed per year. However, in case of high fuel prices, a gain of 4 % would be reached already at 750 m3 fuel consumed per year.

Results optimistic scenario

For the optimistic scenario, the Net Present Value (period 2016 – 2030) is positive already starting from an annual fuel consumption of around 50 m3. Already at this relatively low fuel consumption of 50 m3 per year the Internal Rate of Return accepts values of 12 % and 29 % at average and high fuel prices, respectively. This means that also for smaller vessels below 86 metres that operate on daily basis the business case can be positive.

- Owner(s) / Author(s)

- Prominent

- Publication date

- 21/11/2015

- Date of entry

- 19/06/2018

- Date of updated

- 23/08/2018